Death Benefits

Death benefit options - What happens after your death?

What happens on your death will depend on what options you had previously chosen for your pension pot(s) and your age.

Money purchase pensions

If you have money in an untouched pension pot or pension drawdown, and the plan allows it, your remaining fund can be transferred to your chosen beneficiaries who can then take unlimited income from the fund at any time.

Most SIPP and drawdown plans offer three options following the death of the plan holder:

- Pay the balance of the drawdown pot as a cash lump sum

- Arrange flexi-access drawdown for beneficiaries (no income needs to be taken)

- Purchase an annuity for selected beneficiaries, normally a spouse / partner

Annuities

If you had purchased an annuity with a joint life option the income will continue to the named person. If there is still a benefit from a guarantee period or value protection option this can benefit your loved ones.

Tax

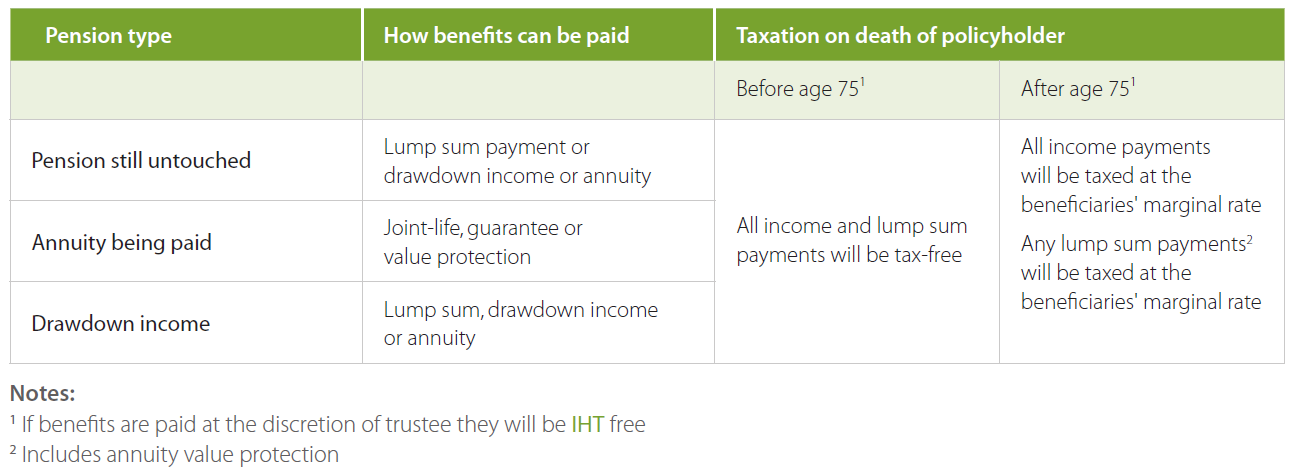

If you die before the age of 75 your beneficiaries will have no tax to pay on any lump sum or income but if you die after the age of 75 they will pay tax on any income taken at their marginal rate.

The table below summaries the death benefit options:

There are three types of beneficiary; a dependant, a nominee and a successor. A dependant is a spouse, civil partner, child under the age of 23 or someone who was financially dependent on the plan holder. A nominee is anyone nominated by the member and a successor is anyone nominated by one of the beneficiaries. In short, almost anybody can be nominated to be a beneficiary of a pension pot.

Although many people may choose to nominate their spouse or partner as a beneficiary, it is possible to nominate children or other family members or friends as beneficiaries and so the pension fund can be handed from one generation to another.

You can leave money to your family - After your death, any money remaining in your pension pot can be left to your beneficiaries.

You can name anybody as a beneficiary. In most cases you will probably choose your spouse or partner as the beneficiary, but you can nominate your children, grandchildren, family friend or even a charity. Technically the final choice of beneficiary is at the discretion of the trustees responsible for overseeing the pension plan but in most cases, they follow your wishes. This means that any transfers or cash payments are normally free of Inheritance Tax.

On death of the beneficiary any remaining drawdown funds may be passed on to their beneficiaries which means that pensions can be passed from generation to generation.