Enhanced Annuity

Higher income for those with poor health

Standard annuity rates are calculated with reference to the average life expectancy for people living in the UK. This is fine for those in good health, but not so good for those who have below average life expectancy.

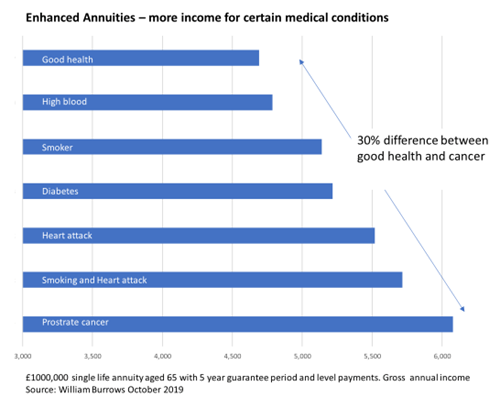

An enhanced or impaired life annuity pays a higher income because an allowance is made for any medical conditions which might reduce life expectancy

You will probably qualify for an enhanced annuity if you can answer yes to one of the following questions:

- Do you smoke?

- Are you taking prescription medication?

- Have you been to hospital recently for a medical condition?

Sample enhancements

Your health is important when planning ahead for retirement.

In good health

If you are in good health annuities may be a good bet – after all they are essentially a bet with the insurance company and if you think you will live a long time you may win the bet.

The case of Madame CalmentAt the age of 90 Madame Calment entered into an annuity contract with her lawyer, Andre Raffray. He agreed to pay her a monthly income in return for her apartment when she died. This proved to be a bad deal for the lawyer because he died first, having paid out nearly double the value of the property. Madame Calment was 121 when Monsieur Raffray died; his family continued paying out until she died a year later at the ripe old age of 122. |

In poor health

However, if you are in poor health you may have a difficult decision:

On the one hand you can leave your pensions invested in drawdown and when you die the remaining money can be left to your family

On the other hand, you can purchase an enhanced annuity which will pay a higher income

Health in later life

When making your retirement plans you should take into account the possibility you may have to budget for expensive care or medical fees in later life.